The Ins and Outs of Envisage and Long-Term Care Insurance Coverage

Many people invest in long-term care Insurance to provide that supplemental coverage. With plans available to fit a variety of budgets, most people can craft a plan that fits some of their long-term care goals – but likely not all.

That’s where Envisage can help. The flexible plans Envisage offers can fill the gaps long-term care Insurance and Medicare coverage may be leaving. If you don’t have long-term care Insurance, Envisage can act in its place to supplement government-provided Medicare plans.

With 70% of people over the age of 65 expected to need an average of three years of long-term care services as they age1, Envisage is the proactive solution to ensure you get to choose the kind of care you receive before you even need it. In addition, with 70% of successful aging being based upon lifestyle choices2, your Personal Wellness & Care Coordinator provided by an Envisage membership – and the many wellness programs we offer – will help you make the best choices to age happily.

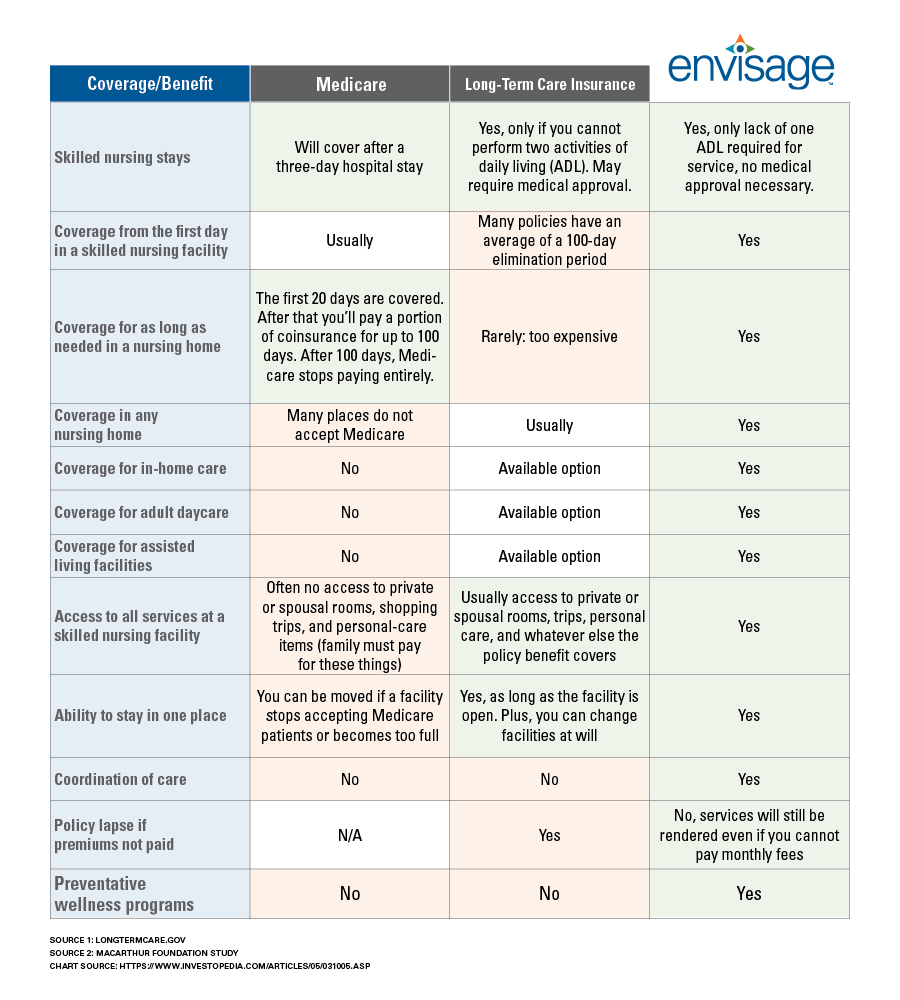

Below is a look at different potential long-term care needs and what each program covers:

Envisage is a long-term planning solution for adults age 60+ that helps provide for future personal care needs to enable you to live in the home you love as you age.